Wells Fargo Stock Forecast: Unveiling Zacks’ Insights for 2024 and Beyond

Navigating the stock market requires a keen understanding of various analytical tools and insights. For investors eyeing Wells Fargo (WFC) stock, a crucial question arises: what does the future hold? This comprehensive guide delves into Wells Fargo stock forecasts, with a particular focus on Zacks Investment Research’s analysis, offering you a detailed perspective on potential investment strategies and market predictions. We’ll explore the factors influencing these forecasts, providing a nuanced understanding that goes beyond simple buy or sell recommendations. Our goal is to empower you with the knowledge to make informed decisions about your investments.

Understanding Wells Fargo’s Performance and Market Position

Wells Fargo, a multinational financial services company, holds a significant position in the banking sector. Its performance is influenced by a multitude of factors, including interest rates, economic growth, regulatory changes, and overall market sentiment. Analyzing these factors is crucial for understanding the foundation upon which any stock forecast is built.

Wells Fargo’s diverse operations, ranging from community banking to wealth management, expose it to various economic cycles. A robust economy typically benefits its lending activities, while market volatility can impact its investment banking and wealth management divisions. Therefore, a holistic view of the macroeconomic environment is essential when evaluating Wells Fargo’s prospects.

Key Factors Influencing Wells Fargo’s Stock Price

- Interest Rate Environment: Changes in interest rates directly impact Wells Fargo’s net interest margin, a key profitability metric.

- Economic Growth: A strong economy fuels loan demand and reduces credit losses, benefiting Wells Fargo’s core banking operations.

- Regulatory Landscape: Banking regulations can significantly impact Wells Fargo’s compliance costs and business strategies.

- Market Sentiment: Overall investor confidence and market trends play a role in determining Wells Fargo’s stock valuation.

- Company-Specific Performance: Wells Fargo’s internal efficiency, risk management, and strategic initiatives are crucial drivers of its stock performance.

Decoding Zacks Investment Research’s Approach to Stock Forecasting

Zacks Investment Research is a well-known provider of investment analysis and recommendations. Their stock forecasts are based on a proprietary methodology that combines earnings estimate revisions, fundamental analysis, and quantitative data. Understanding how Zacks arrives at its forecasts is essential for interpreting their ratings and price targets for Wells Fargo.

Zacks’ emphasis on earnings estimate revisions is a key differentiator. They believe that changes in analyst expectations for a company’s future earnings are a powerful predictor of stock price movements. A positive revision trend often signals increased confidence in the company’s prospects, potentially leading to a higher stock price.

The Zacks Rank: A Powerful Tool for Stock Selection

The Zacks Rank is a core component of their stock forecasting system. It assigns a rating from #1 (Strong Buy) to #5 (Strong Sell) based on the magnitude and direction of earnings estimate revisions. A Zacks Rank #1 stock has historically outperformed the market, while a Zacks Rank #5 stock has underperformed.

While the Zacks Rank can be a valuable tool, it’s important to remember that it’s just one factor to consider. Investors should conduct their own due diligence and consider other factors, such as fundamental analysis, valuation metrics, and risk tolerance, before making any investment decisions.

Analyzing Wells Fargo Stock Forecasts: A Deep Dive into the Numbers

Obtaining the most recent Wells Fargo stock forecast from Zacks requires a direct visit to their website or a subscription to their research services. However, we can analyze the general factors that Zacks likely considers and how to interpret such a forecast.

A typical Zacks stock forecast includes a rating (e.g., Strong Buy, Hold, Sell), a price target (an estimate of where the stock price will be in the future), and a commentary outlining the rationale behind the forecast. Pay close attention to the reasons cited for the forecast, as they provide valuable insights into the factors driving Zacks’ outlook.

Interpreting Zacks’ Ratings and Price Targets

- Strong Buy: Indicates that Zacks believes the stock is likely to outperform the market in the coming months.

- Buy: Suggests that the stock is expected to perform better than the market average.

- Hold: Implies that the stock is fairly valued and is expected to perform in line with the market.

- Sell: Indicates that the stock is likely to underperform the market.

- Strong Sell: Suggests that the stock is expected to significantly underperform the market.

The price target represents Zacks’ estimate of the stock’s future value. It’s important to note that price targets are not guarantees and can be subject to change based on market conditions and company performance.

Wells Fargo’s Financial Health: A Foundation for Forecasting

Beyond Zacks’ analysis, evaluating Wells Fargo’s financial health is paramount. Key metrics to consider include revenue growth, profitability margins, asset quality, and capital adequacy. These indicators provide a snapshot of the company’s financial strength and its ability to generate future earnings.

A healthy balance sheet, characterized by strong capital ratios and low levels of non-performing assets, is a positive sign. Consistent revenue growth and expanding profit margins indicate that Wells Fargo is effectively managing its operations and capitalizing on market opportunities. These factors contribute to a more optimistic outlook for the stock.

Key Financial Metrics to Watch

- Net Interest Margin (NIM): Measures the difference between interest income and interest expense, indicating profitability from lending activities.

- Return on Equity (ROE): Gauges how effectively Wells Fargo is using shareholder equity to generate profits.

- Efficiency Ratio: Measures operating expenses as a percentage of revenue, indicating operational efficiency.

- Non-Performing Assets (NPAs): Reflects the quality of Wells Fargo’s loan portfolio and its ability to manage credit risk.

- Capital Ratios (e.g., Tier 1 Capital Ratio): Indicate Wells Fargo’s financial strength and its ability to absorb potential losses.

The Competitive Landscape: Wells Fargo vs. Its Peers

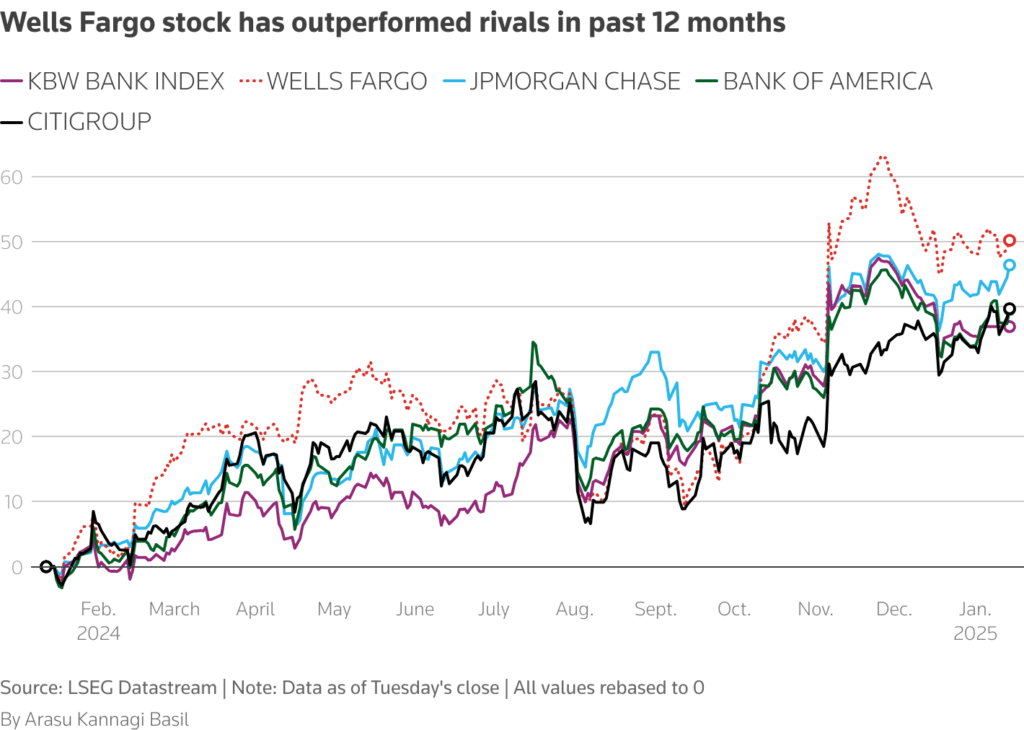

Understanding Wells Fargo’s position within the competitive landscape is crucial for assessing its long-term prospects. Comparing its performance and valuation metrics to those of its peers, such as JPMorgan Chase, Bank of America, and Citigroup, provides valuable context.

Factors to consider include market share, product offerings, geographic footprint, and technological innovation. A company that consistently outperforms its peers in key areas is likely to generate superior returns for investors.

Benchmarking Wells Fargo Against Competitors

- Market Share: Compare Wells Fargo’s market share in key business segments to that of its competitors.

- Product Innovation: Assess Wells Fargo’s ability to develop and launch new products and services that meet evolving customer needs.

- Technological Advancement: Evaluate Wells Fargo’s investments in technology and its ability to leverage digital platforms to enhance customer experience and improve efficiency.

- Risk Management: Compare Wells Fargo’s risk management practices to those of its peers, particularly in areas such as credit risk and operational risk.

- Customer Satisfaction: Assess Wells Fargo’s customer satisfaction ratings and its ability to build and maintain strong customer relationships.

Risk Factors to Consider Before Investing in Wells Fargo

Investing in any stock involves inherent risks, and Wells Fargo is no exception. Understanding these risks is essential for making informed investment decisions. Key risk factors to consider include regulatory challenges, cybersecurity threats, economic downturns, and reputational damage.

Wells Fargo has faced regulatory scrutiny in the past, and ongoing compliance efforts can be costly. Cybersecurity threats pose a constant risk to its operations and customer data. An economic downturn could negatively impact its lending activities and profitability. Reputational damage, stemming from past scandals or negative publicity, can erode customer trust and impact its stock price.

Identifying and Assessing Potential Risks

- Regulatory Risk: Assess the potential impact of new or changing regulations on Wells Fargo’s business.

- Cybersecurity Risk: Evaluate Wells Fargo’s preparedness for and resilience against cyberattacks.

- Economic Risk: Consider the potential impact of an economic recession or slowdown on Wells Fargo’s earnings.

- Reputational Risk: Monitor news and social media for any negative publicity that could damage Wells Fargo’s reputation.

- Interest Rate Risk: Assess the potential impact of rising or falling interest rates on Wells Fargo’s net interest margin.

Wells Fargo’s Dividend Policy: A Source of Investor Income

Wells Fargo has a history of paying dividends to its shareholders. The dividend yield, which is the annual dividend payment divided by the stock price, is an important factor for income-seeking investors. Understanding Wells Fargo’s dividend policy and its ability to sustain dividend payments is crucial for assessing the stock’s overall attractiveness.

Factors to consider include Wells Fargo’s earnings stability, cash flow generation, and capital adequacy. A company with a consistent track record of dividend payments and a healthy payout ratio (the percentage of earnings paid out as dividends) is generally considered to be a more reliable source of income.

Evaluating Wells Fargo’s Dividend Sustainability

- Dividend Yield: Compare Wells Fargo’s dividend yield to that of its peers and the overall market.

- Payout Ratio: Assess the sustainability of Wells Fargo’s dividend payments by examining its payout ratio.

- Cash Flow Generation: Evaluate Wells Fargo’s ability to generate sufficient cash flow to cover its dividend payments.

- Capital Adequacy: Ensure that Wells Fargo has sufficient capital reserves to maintain its dividend payments during economic downturns.

- Dividend History: Review Wells Fargo’s historical dividend payments for consistency and growth.

Wells Fargo Stock Forecasts and Long-Term Investment Strategies

Wells Fargo stock forecasts, including those from Zacks, should be viewed as one piece of the puzzle when developing a long-term investment strategy. It’s essential to align your investment decisions with your individual risk tolerance, time horizon, and financial goals.

A long-term investment strategy typically involves holding a stock for several years or even decades, allowing it to grow over time. This approach requires careful consideration of the company’s fundamentals, its competitive position, and its long-term growth prospects. Diversification, which involves spreading your investments across different asset classes and sectors, is also crucial for managing risk.

Building a Diversified Portfolio with Wells Fargo

- Assess Your Risk Tolerance: Determine how much risk you are willing to take with your investments.

- Define Your Time Horizon: Consider how long you plan to hold your investments.

- Set Your Financial Goals: Identify your financial objectives, such as retirement planning or wealth accumulation.

- Diversify Your Portfolio: Spread your investments across different asset classes and sectors to reduce risk.

- Regularly Review Your Portfolio: Periodically review your portfolio to ensure that it remains aligned with your investment goals and risk tolerance.

The Future of Wells Fargo: Navigating a Changing Financial Landscape

The financial services industry is constantly evolving, driven by technological innovation, changing customer preferences, and increasing regulatory scrutiny. Wells Fargo’s ability to adapt to these changes will be crucial for its long-term success.

Investing in technology, enhancing customer experience, and strengthening risk management are key priorities for Wells Fargo. The company’s ability to navigate the changing financial landscape will ultimately determine its future growth prospects and its attractiveness as an investment.

Adapting to the Evolving Financial Landscape

- Technological Innovation: Embrace digital technologies to enhance customer experience and improve operational efficiency.

- Customer-Centric Approach: Focus on meeting the evolving needs and expectations of customers.

- Risk Management: Strengthen risk management practices to mitigate potential threats and ensure financial stability.

- Regulatory Compliance: Maintain a strong commitment to regulatory compliance.

- Strategic Partnerships: Explore strategic partnerships to expand its reach and offer new products and services.

Expert Insights on Wells Fargo’s Growth Trajectory

While stock forecasts provide a snapshot of potential future performance, understanding the broader context of Wells Fargo’s growth trajectory requires insights from industry experts and financial analysts. These experts often provide valuable perspectives on the company’s strategic initiatives, competitive advantages, and potential challenges.

By following expert commentary and analysis, investors can gain a deeper understanding of the factors driving Wells Fargo’s long-term growth prospects. This information can help inform investment decisions and provide a more nuanced perspective on the stock’s potential.

Leveraging Expert Analysis for Informed Decisions

- Follow Industry Experts: Stay informed about the latest insights and analysis from leading financial experts.

- Read Analyst Reports: Review analyst reports to gain a deeper understanding of Wells Fargo’s financial performance and future prospects.

- Attend Investor Conferences: Participate in investor conferences to hear directly from Wells Fargo’s management team.

- Monitor Financial News: Stay up-to-date on the latest news and developments related to Wells Fargo and the financial services industry.

- Consider Multiple Perspectives: Evaluate different perspectives and opinions to form your own informed investment decisions.

Wells Fargo Stock: A Forward-Looking Perspective

Ultimately, understanding the “wells fargo stock forecast zacks” and other analytical outlooks requires a holistic approach. By considering various factors, including Wells Fargo’s financial health, competitive landscape, risk factors, and dividend policy, investors can develop a well-informed investment strategy aligned with their individual goals. Remember that stock forecasts are not guarantees, but rather tools to aid in your research and decision-making process. It’s essential to stay informed, adapt to changing market conditions, and seek professional advice when needed. Explore further resources and tools to enhance your understanding of the stock market and make confident investment choices.