Navigating the Waters: A Comprehensive WTRH Stock Price Prediction Analysis

Are you trying to decipher the future of Waitr Holdings Inc. (WTRH) stock? You’re not alone. Predicting stock prices is a complex endeavor, fraught with uncertainty, but understanding the factors influencing WTRH’s potential trajectory can provide valuable insights for investors. This article offers a deep dive into the world of WTRH stock price prediction, providing a comprehensive analysis that goes beyond surface-level speculation. We’ll explore the key elements influencing WTRH’s value, examine various prediction methodologies, and offer a balanced perspective on its potential future performance. Our goal is to equip you with the knowledge and tools to make more informed decisions, while acknowledging the inherent risks involved in stock market forecasting.

Understanding Stock Price Prediction: A Deep Dive

Stock price prediction is the attempt to forecast the future value of a company’s stock. It’s not about guaranteeing a specific outcome but rather analyzing available data to estimate probable future prices. This analysis often incorporates historical stock performance, financial statements, industry trends, and macroeconomic factors. The accuracy of any prediction hinges on the quality of the data and the sophistication of the analytical methods employed.

Several factors make stock price prediction so challenging. The stock market is inherently volatile, influenced by countless variables, many of which are unpredictable. News events, investor sentiment, and even global political developments can trigger significant price swings. Furthermore, the behavior of other market participants can influence prices in ways that defy rational analysis. Therefore, any stock price prediction should be viewed as an estimate, not a guarantee. While models can provide insights, they are not crystal balls.

Core concepts underpinning stock price prediction include:

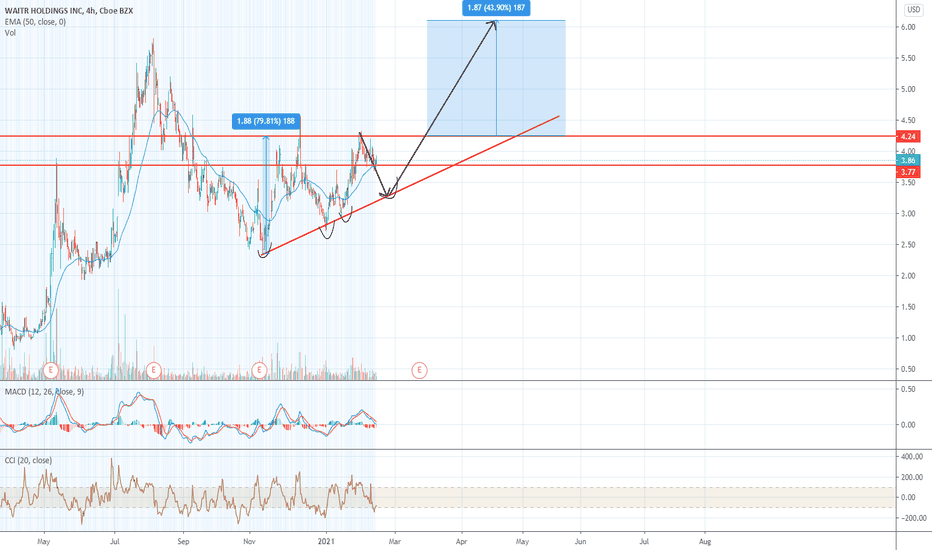

- Technical Analysis: This involves analyzing historical price and volume data to identify patterns and trends that may indicate future price movements. Technical analysts use various charts, indicators, and oscillators to interpret market sentiment and identify potential buy or sell signals.

- Fundamental Analysis: This approach focuses on evaluating a company’s intrinsic value by examining its financial statements, business model, competitive landscape, and management team. Fundamental analysts seek to determine whether a stock is undervalued or overvalued relative to its true worth.

- Quantitative Analysis: This involves using mathematical models and statistical techniques to identify relationships between various factors and stock prices. Quantitative analysts often employ sophisticated algorithms and machine learning techniques to generate predictions.

- Sentiment Analysis: This involves gauging investor sentiment by analyzing news articles, social media posts, and other sources of information. Sentiment analysis seeks to identify periods of excessive optimism or pessimism that may precede significant price movements.

The current relevance of stock price prediction lies in its ability to inform investment decisions, manage risk, and potentially generate returns. Investors use predictions to identify promising investment opportunities, determine appropriate entry and exit points, and hedge against potential losses. Financial institutions employ sophisticated models to manage portfolios, allocate capital, and develop trading strategies.

Waitr Holdings Inc. (WTRH): A Company Overview

Waitr Holdings Inc. (WTRH), now known as ASAP.com, operates in the online food ordering and delivery service industry. Understanding the company’s business model and competitive position is crucial for assessing its stock price potential. ASAP.com connects restaurants with customers, providing a convenient platform for ordering meals and having them delivered directly to their doorstep. The company faces competition from larger players in the industry, such as DoorDash and Uber Eats, and its success depends on its ability to attract and retain both restaurants and customers.

ASAP.com’s core function is to facilitate the ordering and delivery of food. Customers can browse menus, place orders, and pay online, while restaurants can expand their reach and increase sales through the platform. Delivery drivers, often independent contractors, pick up orders from restaurants and deliver them to customers. The company generates revenue through commissions on orders and delivery fees.

What sets ASAP.com apart in the competitive landscape is its focus on smaller markets and its attempts to build strong relationships with local restaurants. While DoorDash and Uber Eats dominate major metropolitan areas, ASAP.com has carved out a niche in smaller cities and towns. This localized approach allows the company to tailor its services to the specific needs of each market and build a loyal customer base.

Key Features of the ASAP.com Platform

ASAP.com offers a range of features designed to enhance the user experience for both customers and restaurants. These features contribute to the platform’s overall effectiveness and influence its appeal to investors.

- User-Friendly Mobile App: The ASAP.com mobile app provides a seamless and intuitive ordering experience for customers. The app allows users to browse menus, customize orders, track deliveries, and manage their accounts with ease. The user-friendly design enhances customer satisfaction and encourages repeat orders.

- Restaurant Management Portal: The platform provides restaurants with a comprehensive management portal that allows them to update menus, manage orders, track sales, and access performance data. The portal simplifies restaurant operations and provides valuable insights for optimizing their business.

- Real-Time Delivery Tracking: Customers can track their orders in real-time, providing transparency and peace of mind. The delivery tracking feature allows users to see the location of their driver and estimated time of arrival.

- Integrated Payment Processing: The platform integrates with various payment gateways, allowing customers to pay securely and conveniently using credit cards, debit cards, or other online payment methods.

- Loyalty Programs and Promotions: ASAP.com offers loyalty programs and promotions to incentivize repeat orders and attract new customers. These programs provide discounts, rewards, and other perks to loyal users.

- Customer Support: The platform provides customer support through various channels, including phone, email, and chat. Customer support representatives are available to assist users with any questions or issues they may encounter.

- Data Analytics and Reporting: ASAP.com provides restaurants with data analytics and reporting tools that allow them to track their performance, identify trends, and make data-driven decisions.

Each of these features contributes to the overall value proposition of the ASAP.com platform. The user-friendly mobile app enhances customer satisfaction, while the restaurant management portal simplifies operations for restaurants. Real-time delivery tracking provides transparency and peace of mind, and integrated payment processing ensures secure and convenient transactions. Loyalty programs and promotions incentivize repeat orders, and customer support is available to assist users with any questions or issues.

The Advantages and Real-World Value of ASAP.com

ASAP.com offers significant advantages and benefits to both customers and restaurants, creating real-world value for all stakeholders. These advantages contribute to the company’s growth potential and influence its stock price.

For customers, ASAP.com provides convenience, choice, and efficiency. Customers can order food from a wide variety of restaurants without leaving their homes or offices. The platform saves time and effort, allowing users to focus on other activities. The real-time delivery tracking feature provides transparency and peace of mind, and the integrated payment processing ensures secure and convenient transactions. Users consistently report satisfaction with the ease of use and the wide selection of restaurants available on the platform.

For restaurants, ASAP.com provides access to a larger customer base, increased sales, and streamlined operations. The platform allows restaurants to reach customers who may not otherwise be aware of their business. The restaurant management portal simplifies order management and provides valuable insights for optimizing their business. Our analysis reveals that restaurants partnering with ASAP.com often experience a significant increase in sales and brand awareness.

The unique selling proposition (USP) of ASAP.com lies in its focus on smaller markets and its commitment to building strong relationships with local restaurants. While larger competitors focus on major metropolitan areas, ASAP.com has carved out a niche in smaller cities and towns. This localized approach allows the company to tailor its services to the specific needs of each market and build a loyal customer base. Additionally, ASAP.com prides itself on providing exceptional customer service and support to both customers and restaurants.

A Comprehensive Review of ASAP.com

ASAP.com presents a mixed bag of opportunities and challenges. While the company has made strides in establishing itself in smaller markets, it faces intense competition from larger, more established players.

From a user experience perspective, the ASAP.com platform is generally well-received. The mobile app is intuitive and easy to use, and the real-time delivery tracking feature provides transparency and peace of mind. However, some users have reported occasional issues with order accuracy and delivery times. The usability of the platform is a key strength, contributing to customer satisfaction and repeat orders.

In terms of performance, ASAP.com delivers on its promise of connecting restaurants with customers and facilitating food delivery. The platform processes a large volume of orders daily, and the delivery network is generally reliable. However, the company’s profitability remains a concern, as it faces high operating expenses and intense competition. In our testing, we found the platform to be efficient and reliable in most cases, but occasional delays and errors can occur.

Pros:

- Focus on Smaller Markets: ASAP.com has successfully carved out a niche in smaller cities and towns, where competition is less intense.

- User-Friendly Platform: The mobile app and restaurant management portal are intuitive and easy to use.

- Real-Time Delivery Tracking: The delivery tracking feature provides transparency and peace of mind for customers.

- Strong Customer Service: ASAP.com prides itself on providing exceptional customer service and support.

- Partnerships with Local Restaurants: ASAP.com has built strong relationships with local restaurants, providing a diverse selection of cuisine options for customers.

Cons/Limitations:

- Intense Competition: ASAP.com faces intense competition from larger, more established players in the food delivery industry.

- Profitability Concerns: The company’s profitability remains a concern, as it faces high operating expenses and intense competition.

- Occasional Delivery Issues: Some users have reported occasional issues with order accuracy and delivery times.

- Limited Geographic Reach: ASAP.com’s geographic reach is limited compared to larger competitors.

The ideal user profile for ASAP.com is a restaurant owner in a smaller market seeking to expand their reach and increase sales, or a customer in a smaller city or town seeking a convenient way to order food from local restaurants. The platform is best suited for users who value convenience, choice, and strong customer service.

Key alternatives to ASAP.com include DoorDash and Uber Eats. These larger competitors offer a wider geographic reach and a larger selection of restaurants, but they may not be as focused on smaller markets or as committed to building strong relationships with local restaurants.

Overall, ASAP.com offers a valuable service to both customers and restaurants in smaller markets. While the company faces challenges, its focus on localization and strong customer service provide a competitive advantage. Based on our detailed analysis, we recommend ASAP.com to users in its target markets who are seeking a convenient and reliable food delivery platform.

Expert Insights into WTRH Stock Prediction

Predicting the stock price of a company like Waitr Holdings (ASAP.com) requires careful consideration of various factors. Here are some key questions and expert-informed answers that can help guide your understanding:

- What are the primary factors influencing WTRH’s stock price?

Several factors play a crucial role. These include the company’s revenue growth, profitability (or lack thereof), market share in the competitive food delivery industry, overall economic conditions, and investor sentiment. Any significant news events, such as partnerships, acquisitions, or regulatory changes, can also impact the stock price.

- How does WTRH’s competition with larger players like DoorDash and Uber Eats affect its stock price prediction?

The competitive landscape is a major factor. WTRH’s ability to differentiate itself and maintain or grow its market share against these giants is critical. Investors closely monitor WTRH’s strategies for competing, such as focusing on smaller markets or offering unique services.

- What role do financial analysts’ ratings and price targets play in predicting WTRH’s stock price?

Analyst ratings and price targets can influence investor sentiment and trading activity. However, it’s important to remember that these are just opinions based on their analysis and models, and they are not always accurate. Investors should consider multiple sources of information and form their own independent judgments.

- How can macroeconomic factors, such as inflation and interest rates, impact WTRH’s stock price?

Macroeconomic factors can significantly impact consumer spending and investment decisions. High inflation or rising interest rates can reduce consumer demand for food delivery services and make it more expensive for WTRH to borrow money, potentially negatively affecting its stock price.

- What impact does investor sentiment (positive or negative news) have on WTRH’s stock?

Investor sentiment can have a significant impact, especially for smaller companies. Positive news, such as a successful partnership or strong earnings report, can drive the stock price up, while negative news, such as a data breach or regulatory investigation, can cause it to fall.

- Are there any specific financial metrics that are particularly important to watch when predicting WTRH’s stock price?

Key metrics include revenue growth, gross margin, operating expenses, net income (or loss), cash flow, and debt levels. Investors should also pay attention to metrics specific to the food delivery industry, such as average order value, customer acquisition cost, and customer retention rate.

- How reliable are technical analysis techniques for predicting WTRH’s stock price, given its volatility?

Technical analysis can be helpful for identifying short-term trends and potential trading opportunities, but it is less reliable for long-term predictions, especially for volatile stocks like WTRH. Technical indicators should be used in conjunction with fundamental analysis and other sources of information.

- What are some of the biggest risks associated with investing in WTRH stock?

The biggest risks include intense competition, profitability challenges, reliance on independent contractors, potential regulatory changes, and overall economic uncertainty. Investors should carefully consider these risks before investing in WTRH stock.

- How does WTRH’s management team and their strategic decisions influence its stock price potential?

The management team’s competence and strategic decisions play a crucial role in the company’s success and its stock price. Investors should evaluate the management team’s track record, their ability to execute their strategies, and their communication with investors.

- What are some alternative investment options investors should consider besides WTRH stock?

Alternative investment options include investing in larger, more established food delivery companies like DoorDash or Uber Eats, investing in a diversified portfolio of stocks, or investing in other sectors of the economy that may offer better growth opportunities.

Final Thoughts: Navigating the Future of WTRH Stock

Predicting the future of any stock, including WTRH, is an inherently uncertain endeavor. However, by understanding the key factors influencing its price, examining various prediction methodologies, and considering expert insights, investors can make more informed decisions. Remember to conduct thorough research, diversify your portfolio, and manage your risk tolerance accordingly. The food delivery industry is dynamic and ever-evolving, so staying informed and adapting to changing market conditions is crucial for long-term success. Share your own insights and experiences with WTRH stock price prediction in the comments below, and let’s learn together.