Navigating the Texas Housing Market: From Memes to Mortgages

Buying a house in Texas is a dream for many, fueled by images of sprawling ranches, vibrant city life, and, of course, the ever-present memes that capture the unique experience. But beyond the humor lies a complex process. This article delves into the realities of the Texas housing market, offering expert insights and practical advice to help you navigate the journey from meme-worthy moments to successful homeownership. We’ll explore the key considerations, challenges, and opportunities that await you, ensuring you’re well-prepared to make informed decisions and avoid common pitfalls. Our goal is to provide a comprehensive guide that goes beyond the surface, offering a deeper understanding of the Texas real estate landscape and empowering you to achieve your homeownership goals.

Understanding the Texas Housing Market: Beyond the Buying a House in Texas Meme

The Texas housing market is as diverse as the state itself. From the bustling metropolis of Houston to the serene landscapes of the Hill Country, each region offers a unique blend of opportunities and challenges. Understanding these nuances is crucial for making informed decisions.

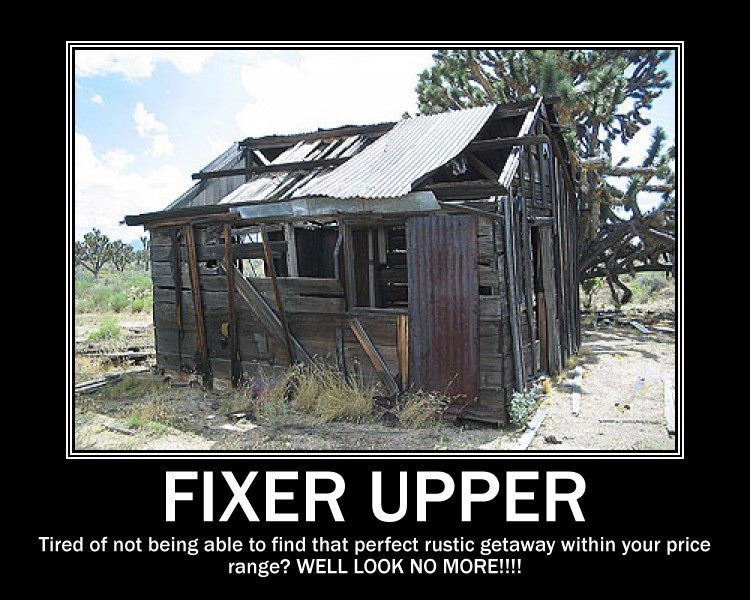

The buying a house in Texas meme often pokes fun at the competitive nature of the market, the rising property taxes, and the sheer size of the state. While humor can be a coping mechanism, it’s essential to approach the process with a realistic understanding of the market dynamics. Factors such as population growth, economic trends, and interest rates all play a significant role in shaping the housing landscape.

Key Market Drivers:

- Population Growth: Texas has consistently been one of the fastest-growing states in the nation, driving demand for housing.

- Economic Diversification: A robust and diverse economy provides stability and attracts new residents.

- Low Interest Rates: Historically low interest rates have made homeownership more accessible, but fluctuations can impact affordability.

- Property Taxes: Texas has relatively high property taxes, which can be a significant expense for homeowners.

- Geographic Diversity: The vastness of Texas offers a wide range of housing options, from urban condos to rural estates.

Navigating the Challenges:

- Competition: In many areas, the market is highly competitive, requiring buyers to act quickly and strategically.

- Affordability: Rising home prices can make it challenging for first-time buyers to enter the market.

- Property Taxes: Understanding and budgeting for property taxes is essential for long-term affordability.

- Homeowners Insurance: Due to weather-related risks, homeowners insurance can be expensive in certain areas.

- Due Diligence: Thorough inspections and research are crucial to avoid costly surprises.

The Role of a Real Estate Agent: Your Guide Through the Texas Terrain

In the complex world of Texas real estate, a knowledgeable and experienced real estate agent is an invaluable asset. They act as your guide, advocate, and negotiator, helping you navigate the intricacies of the market and achieve your homeownership goals.

Expert Guidance:

- Market Knowledge: Agents possess in-depth knowledge of local market trends, property values, and neighborhood dynamics.

- Search Expertise: They can help you identify properties that meet your specific needs and budget, saving you time and effort.

- Negotiation Skills: Agents are skilled negotiators, advocating for your best interests and helping you secure the best possible deal.

- Contract Expertise: They can guide you through the complex paperwork and legal requirements of a real estate transaction.

- Network of Professionals: Agents have established relationships with other professionals, such as lenders, inspectors, and contractors, providing you with a valuable network of resources.

Finding the Right Agent:

- Experience: Look for an agent with a proven track record of success in the Texas market.

- Local Expertise: Choose an agent who specializes in the specific area where you’re looking to buy.

- Communication Skills: Effective communication is essential for a successful working relationship.

- References: Ask for references from past clients to gauge their satisfaction with the agent’s services.

- Personality: Choose an agent who you feel comfortable working with and who understands your needs and goals.

Financing Your Texas Dream: Mortgage Options and Considerations

Securing financing is a critical step in the home buying process. Understanding your mortgage options and preparing your finances can significantly impact your ability to purchase a home in Texas.

Mortgage Options:

- Conventional Loans: These loans are not backed by the government and typically require a higher down payment and credit score.

- FHA Loans: Insured by the Federal Housing Administration, these loans offer more flexible credit requirements and lower down payment options.

- VA Loans: Guaranteed by the Department of Veterans Affairs, these loans are available to eligible veterans and offer favorable terms.

- USDA Loans: Offered by the U.S. Department of Agriculture, these loans are available to eligible rural homebuyers and offer no down payment options.

- Texas State Affordable Housing Corporation (TSAHC) Loans: TSAHC offers various programs to assist first-time homebuyers with down payment assistance and low-interest rates.

Financial Preparation:

- Credit Score: Check your credit score and address any issues before applying for a mortgage.

- Debt-to-Income Ratio: Calculate your debt-to-income ratio to determine how much you can afford to borrow.

- Down Payment: Save for a down payment and explore down payment assistance programs.

- Pre-Approval: Get pre-approved for a mortgage to demonstrate your financial readiness to sellers.

- Budgeting: Create a budget to track your income and expenses and ensure you can afford the ongoing costs of homeownership.

Property Taxes in Texas: Understanding the Costs and Exemptions

Property taxes are a significant expense for Texas homeowners. Understanding how they’re calculated and what exemptions are available can help you budget effectively and potentially reduce your tax burden.

Calculation:

- Appraised Value: Your property’s appraised value is determined by the county appraisal district.

- Tax Rate: The tax rate is set by local taxing entities, such as the city, county, and school district.

- Taxable Value: The taxable value is the appraised value minus any exemptions.

- Property Tax: Your property tax is calculated by multiplying the taxable value by the tax rate.

Exemptions:

- Homestead Exemption: This exemption reduces the taxable value of your primary residence.

- Over-65 Exemption: This exemption is available to homeowners who are 65 years of age or older.

- Disability Exemption: This exemption is available to homeowners with disabilities.

- Veteran Exemption: This exemption is available to eligible veterans.

Strategies for Managing Property Taxes:

- Protest Your Appraisal: If you believe your property’s appraised value is too high, you can protest it with the county appraisal district.

- Apply for Exemptions: Ensure you’re taking advantage of all available exemptions.

- Budget Effectively: Include property taxes in your monthly budget to avoid surprises.

Home Inspections: Unveiling Potential Issues Before You Buy

A home inspection is a crucial step in the home buying process. It provides you with a detailed assessment of the property’s condition, helping you identify potential issues and make informed decisions.

What to Expect:

- Structural Integrity: The inspector will assess the foundation, framing, and roof for any signs of damage or deterioration.

- Electrical System: The inspector will examine the electrical panel, wiring, and outlets for safety and functionality.

- Plumbing System: The inspector will check the pipes, fixtures, and water heater for leaks and proper operation.

- HVAC System: The inspector will evaluate the heating, ventilation, and air conditioning system for efficiency and functionality.

- Appliances: The inspector will test the major appliances, such as the oven, dishwasher, and refrigerator.

Choosing an Inspector:

- Experience: Look for an inspector with a proven track record of success.

- Certifications: Choose an inspector who is certified by a reputable organization, such as the American Society of Home Inspectors (ASHI).

- References: Ask for references from past clients.

- Insurance: Ensure the inspector has adequate insurance coverage.

After the Inspection:

- Review the Report: Carefully review the inspection report and discuss any concerns with the inspector.

- Negotiate Repairs: If the inspection reveals any significant issues, you can negotiate with the seller to have them repaired or reduce the purchase price.

- Walk Away: If the issues are too significant or the seller is unwilling to negotiate, you have the option to walk away from the deal.

Mastering the Texas Real Estate Contract: Key Clauses and Considerations

The Texas Real Estate Contract is a legally binding document that outlines the terms and conditions of the sale. Understanding the key clauses and considerations is essential for protecting your interests.

Key Clauses:

- Parties: Identifies the buyer and seller.

- Property: Describes the property being sold.

- Purchase Price: States the agreed-upon purchase price.

- Earnest Money: Specifies the amount of earnest money and how it will be handled.

- Financing: Outlines the financing terms, including the loan amount, interest rate, and loan type.

- Title Policy: Specifies who will provide the title policy and what it will cover.

- Property Condition: Addresses the condition of the property and any required repairs.

- Closing Date: Sets the date for the closing of the sale.

Important Considerations:

- Contingencies: Include contingencies to protect your interests, such as a financing contingency and an inspection contingency.

- Amendments: Use amendments to make changes to the contract after it has been signed.

- Legal Advice: Consult with an attorney to review the contract and ensure it protects your interests.

The Closing Process: Completing Your Texas Home Purchase

The closing process is the final step in the home buying journey. It involves the transfer of ownership from the seller to the buyer and the disbursement of funds.

What to Expect:

- Final Walk-Through: Conduct a final walk-through of the property to ensure it’s in the agreed-upon condition.

- Closing Documents: Review and sign the closing documents, including the deed, mortgage, and settlement statement.

- Funding: The lender will disburse the loan funds to the title company.

- Title Transfer: The title company will transfer ownership of the property to you.

- Keys: You’ll receive the keys to your new home!

From Memes to Reality: Achieving Your Texas Homeownership Dream

Buying a house in Texas can be a challenging but rewarding experience. By understanding the market dynamics, working with experienced professionals, and preparing your finances, you can navigate the complexities and achieve your homeownership goals. While the buying a house in Texas meme captures some of the humorous aspects of the process, it’s important to approach it with a realistic and informed perspective.

The Texas housing market offers a diverse range of opportunities for those seeking to put down roots in this vibrant state. Whether you’re drawn to the bustling cities, the serene countryside, or the unique culture, Texas has something to offer everyone. By taking the time to educate yourself and seek expert guidance, you can transform your dream of owning a home in Texas into a reality.

Ready to take the next step? Explore our comprehensive guide to finding the perfect neighborhood in Texas and discover the hidden gems that await you.