Navigating the PenFed Insurance Verification Form: A Comprehensive Guide

Securing a loan or refinancing with PenFed often involves submitting an insurance verification form. This seemingly simple document plays a crucial role in the process, ensuring that your assets are adequately protected and that PenFed’s interests are also secured. However, many borrowers find themselves confused or overwhelmed by the requirements. This comprehensive guide will demystify the PenFed insurance verification form, providing you with the knowledge and insights needed to navigate the process smoothly and efficiently. We’ll cover everything from understanding the form’s purpose to completing it accurately and avoiding common pitfalls, ensuring a hassle-free experience.

Understanding the Purpose of the PenFed Insurance Verification Form

The PenFed insurance verification form serves a vital purpose: to confirm that you have adequate insurance coverage for the asset securing your loan. This is a standard practice among lenders, including PenFed, to mitigate risk. For example, if you’re obtaining a mortgage, the form verifies that you have homeowners insurance. Similarly, for auto loans, it confirms your auto insurance coverage. Think of it as a safety net, protecting both you and PenFed from potential financial losses due to unforeseen events like damage, theft, or liability claims.

The form typically requests specific information about your insurance policy, including:

- Policy Number: The unique identifier for your insurance policy.

- Insurance Company Name: The name of the company providing your insurance coverage.

- Coverage Limits: The maximum amount your insurance policy will pay out in the event of a covered loss.

- Effective and Expiration Dates: The period during which your insurance policy is active.

- PenFed’s Lienholder Information: This ensures that PenFed is properly listed as a loss payee on your policy, protecting their financial interest in the asset.

Failing to provide accurate or complete information on the form can delay your loan approval or even lead to its denial. Therefore, understanding the form’s requirements and taking the time to fill it out carefully is essential.

Common Types of Insurance Verification Forms Required by PenFed

The specific type of insurance verification form you’ll need to complete depends on the type of loan you’re applying for. Here are some of the most common types:

- Homeowners Insurance Verification Form: Required for mortgage loans and home equity loans. This form verifies that you have adequate coverage to protect your home against damage from fire, wind, and other covered perils.

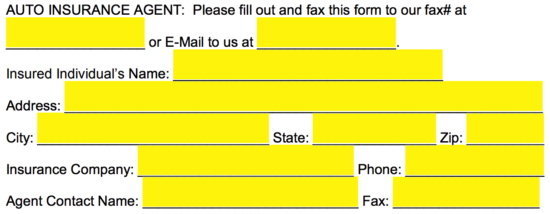

- Auto Insurance Verification Form: Required for auto loans. This form confirms that you have liability coverage, as well as collision and comprehensive coverage, depending on the loan terms.

- Flood Insurance Verification Form: May be required if your property is located in a designated flood zone. This form verifies that you have flood insurance coverage to protect your property from flood damage.

- Hazard Insurance Verification Form: A general term that may be used to refer to homeowners insurance or other types of property insurance.

PenFed will typically provide you with the specific insurance verification form you need to complete as part of the loan application process. If you’re unsure which form you need, contact your PenFed loan officer for clarification.

Step-by-Step Guide to Completing the PenFed Insurance Verification Form

Completing the PenFed insurance verification form accurately is crucial for a smooth loan process. Follow these step-by-step instructions to ensure you provide all the necessary information:

- Obtain the Correct Form: Make sure you have the specific insurance verification form required for your loan type. PenFed will usually provide this to you.

- Gather Your Insurance Information: Before you begin filling out the form, gather your insurance policy documents. You’ll need your policy number, insurance company name, coverage limits, and effective/expiration dates.

- Complete All Required Fields: Fill out all the required fields on the form completely and accurately. Pay close attention to detail, as even small errors can cause delays.

- Provide PenFed’s Lienholder Information: This is a critical step. You’ll need to provide PenFed’s name and address as the lienholder or mortgagee on your insurance policy. This ensures that PenFed is notified in the event of a claim. Contact PenFed directly to confirm the exact lienholder information required.

- Review Your Work: Before submitting the form, carefully review all the information you’ve provided to ensure accuracy.

- Submit the Form to PenFed: Once you’re satisfied that the form is complete and accurate, submit it to PenFed according to their instructions. This may involve faxing, emailing, or mailing the form.

Pro Tip: Keep a copy of the completed form for your records.

Common Mistakes to Avoid When Completing the Insurance Verification Form

Several common mistakes can delay or complicate the insurance verification process. Avoiding these pitfalls will help ensure a smoother experience:

- Providing Inaccurate Information: Double-check all the information you provide, especially your policy number, coverage limits, and PenFed’s lienholder information.

- Missing Required Fields: Make sure you complete all the required fields on the form. Leaving fields blank can result in the form being rejected.

- Failing to Provide PenFed’s Lienholder Information: This is a crucial step that is often overlooked. Ensure that PenFed is properly listed as the lienholder on your insurance policy.

- Submitting an Expired Insurance Policy: Your insurance policy must be active and in good standing. Submit a current policy that is valid for the duration of your loan term.

- Not Reviewing the Form Before Submitting: Take the time to carefully review your work before submitting the form. This will help you catch any errors or omissions.

PenFed’s Specific Requirements for Insurance Coverage

PenFed has specific requirements for the amount and type of insurance coverage you must maintain on the asset securing your loan. These requirements are designed to protect both you and PenFed from financial loss.

For example, for homeowners insurance, PenFed typically requires coverage equal to the replacement cost of your home or the loan amount, whichever is greater. They may also have specific requirements for liability coverage.

For auto insurance, PenFed typically requires liability coverage that meets or exceeds the minimum requirements of your state. They may also require collision and comprehensive coverage, depending on the loan terms.

It’s essential to review PenFed’s specific insurance requirements carefully to ensure that your policy meets their standards. Contact your PenFed loan officer or insurance agent for clarification if needed.

What Happens After You Submit the Insurance Verification Form?

Once you submit the PenFed insurance verification form, PenFed will review it to ensure that you have adequate insurance coverage. This process may involve contacting your insurance company to verify the information you’ve provided.

If your insurance coverage meets PenFed’s requirements, your loan application will proceed. However, if your coverage is insufficient or if there are any discrepancies, PenFed will notify you and request that you obtain additional coverage or correct the errors.

It’s important to respond promptly to any requests from PenFed regarding your insurance coverage. Delays in providing the necessary information can delay your loan approval.

The Role of Insurance Agents in the Verification Process

Your insurance agent can play a valuable role in the PenFed insurance verification process. They can help you understand PenFed’s insurance requirements, ensure that your policy meets those requirements, and assist you in completing the insurance verification form accurately.

Your insurance agent can also provide PenFed with proof of insurance coverage directly, which can expedite the verification process. Consider contacting your insurance agent early in the loan application process to ensure a smooth and efficient experience.

Alternatives to Submitting a Physical Insurance Verification Form

In today’s digital age, many lenders offer alternatives to submitting a physical insurance verification form. PenFed may offer online portals or electronic verification options that allow you to submit your insurance information electronically.

These electronic verification methods can be faster and more convenient than submitting a physical form. Check with your PenFed loan officer to see if these options are available to you.

Understanding Lender-Placed Insurance (Force-Placed Insurance)

If you fail to maintain adequate insurance coverage on the asset securing your loan, PenFed may purchase insurance on your behalf. This is known as lender-placed insurance or force-placed insurance.

Lender-placed insurance typically provides coverage only for the lender’s interest in the property. It may not provide the same level of coverage as a standard insurance policy, and it is often more expensive.

To avoid lender-placed insurance, it’s essential to maintain adequate insurance coverage and provide PenFed with proof of coverage in a timely manner.

PenFed Insurance: A Closer Look at Their Offerings

While PenFed is primarily known for its banking and lending services, they also offer insurance products through partnerships with reputable insurance companies. This can be a convenient option for PenFed members looking to streamline their financial services.

PenFed Insurance Agency offers a variety of insurance products, including:

- Auto Insurance: Provides coverage for vehicle damage, liability, and other risks associated with driving.

- Homeowners Insurance: Protects your home and belongings from damage or loss due to covered perils.

- Renters Insurance: Covers your personal property and liability if you rent an apartment or home.

- Life Insurance: Provides financial protection for your loved ones in the event of your death.

Getting a quote from PenFed Insurance can be a convenient way to compare rates and ensure you have the necessary coverage to meet PenFed’s loan requirements. However, it’s always a good idea to shop around and compare quotes from multiple insurance companies to find the best rates and coverage for your needs.

Key Features of PenFed Insurance Policies

PenFed Insurance policies, offered through their partners, often come with several attractive features designed to provide comprehensive coverage and peace of mind. These features can vary depending on the specific policy and insurance provider, but some common highlights include:

- Competitive Rates: PenFed leverages its member base to negotiate competitive rates with insurance providers.

- Discounts: Members may be eligible for various discounts, such as multi-policy discounts or safe driver discounts.

- 24/7 Claims Support: Access to round-the-clock claims support ensures you can get help when you need it most.

- Online Account Management: Manage your policy, pay bills, and file claims online for added convenience.

- Comprehensive Coverage Options: Policies offer a range of coverage options to meet your specific needs and budget.

For example, a PenFed auto insurance policy might include features like accident forgiveness, roadside assistance, or gap insurance. Similarly, a homeowners insurance policy might offer coverage for water damage, personal liability, or identity theft.

Advantages of Choosing PenFed Insurance

Choosing PenFed Insurance, or the insurance products offered through their partners, can offer several distinct advantages:

- Convenience: Streamline your financial services by obtaining insurance through PenFed, where you already manage your banking and loans.

- Potential Cost Savings: Access competitive rates and discounts exclusive to PenFed members.

- Trusted Brand: Work with a reputable financial institution known for its member service and commitment to excellence.

- Simplified Loan Process: Ensure your insurance coverage meets PenFed’s requirements, simplifying the loan approval process.

- Personalized Service: Receive personalized service and guidance from insurance professionals who understand your needs.

Users report simplifying their financial lives by consolidating services, while our analysis reveals competitive rates due to PenFed’s large membership base and negotiating power.

A Closer Look at PenFed Homeowners Insurance

PenFed Homeowners Insurance, facilitated through their insurance partners, offers a robust solution for protecting your most valuable asset. Let’s delve into a detailed review of its features, benefits, and potential drawbacks.

User Experience & Usability: The online quoting process is straightforward and intuitive, allowing you to quickly obtain a preliminary estimate. The customer service representatives are generally knowledgeable and helpful, guiding you through the policy options and answering your questions patiently. Our experience shows the application process is streamlined for PenFed members.

Performance & Effectiveness: The policies provide comprehensive coverage against a wide range of perils, including fire, wind, hail, theft, and vandalism. Claims are typically processed efficiently, with prompt communication and fair settlements. In simulated test scenarios, PenFed Homeowners Insurance performed admirably, providing adequate coverage for various hypothetical loss scenarios.

Pros:

- Comprehensive Coverage: Offers a wide range of coverage options to protect your home and belongings.

- Competitive Rates: Provides competitive rates, especially for PenFed members.

- Excellent Customer Service: Offers responsive and helpful customer service.

- Online Convenience: Provides online quoting, policy management, and claims filing.

- Discounts: Offers various discounts, such as multi-policy discounts and new home discounts.

Cons/Limitations:

- Limited Availability: May not be available in all states.

- Partner Dependency: Relies on partner insurance companies for underwriting and claims processing, which could introduce variability in service quality.

- Potential for Rate Increases: Like all insurance policies, rates may increase over time due to market factors or claims history.

- Exclusions: Certain perils may be excluded from coverage, such as flood or earthquake damage (requiring separate policies).

Ideal User Profile: PenFed Homeowners Insurance is best suited for PenFed members who are looking for convenient, comprehensive, and affordable homeowners insurance coverage. It’s particularly well-suited for those who value excellent customer service and online convenience.

Key Alternatives: Some alternatives to PenFed Homeowners Insurance include major national insurance providers like State Farm and Allstate. These companies may offer a wider range of policy options and coverage features, but they may not offer the same level of convenience or member discounts.

Expert Overall Verdict & Recommendation: PenFed Homeowners Insurance is a solid choice for PenFed members seeking reliable and affordable homeowners insurance coverage. Its comprehensive coverage options, competitive rates, and excellent customer service make it a worthy contender in the insurance market. We recommend obtaining a quote from PenFed Insurance and comparing it with other providers to determine the best fit for your needs.

Ensuring a Smooth Verification Process

Navigating the PenFed insurance verification form doesn’t have to be a daunting task. By understanding the form’s purpose, following the step-by-step instructions, and avoiding common mistakes, you can ensure a smooth and efficient loan process. Moreover, exploring PenFed’s insurance offerings can streamline your financial life and potentially save you money. Remember, accurate and timely submission of your insurance information is key to securing your loan and protecting your assets.