Decoding Suncoke Energy’s Stock Price History: A Comprehensive Analysis

Understanding the stock price history of a company like Suncoke Energy (SXC) is crucial for investors seeking to make informed decisions. The fluctuations in its stock price reflect a complex interplay of market forces, industry trends, and company-specific factors. This comprehensive guide delves deep into Suncoke Energy’s stock price history, providing an in-depth analysis of the key events and factors that have shaped its performance over time. We aim to equip you with the knowledge needed to interpret past trends and make more informed predictions about the future.

Suncoke Energy: A Brief Overview

Suncoke Energy, Inc. is a prominent producer of coke, a vital ingredient in the steelmaking process. Their operations primarily involve transforming coal into coke, which is then sold to steel manufacturers. The company’s performance is closely tied to the health of the steel industry, making its stock price history a reflection of global economic trends and the demand for steel.

Unveiling the Historical Stock Performance of Suncoke Energy

Analyzing Suncoke Energy’s stock price history requires a multi-faceted approach. We’ll examine key periods, significant events, and the underlying factors that have influenced the stock’s trajectory. Remember that past performance is not necessarily indicative of future results, but it provides valuable context for understanding the company’s potential.

Early Years and Initial Public Offering (IPO)

Suncoke Energy’s stock price history begins with its initial public offering. Understanding the IPO price, the market conditions at the time, and the initial investor sentiment provides a baseline for analyzing subsequent performance. Did the stock perform well immediately after the IPO? Was there significant volatility? These early trends can offer insights into the market’s initial perception of the company.

Key Milestones and Market Reactions

Throughout its history, Suncoke Energy has experienced various milestones, such as acquisitions, expansions, and significant contracts. Each of these events has likely had an impact on the stock price. Analyzing the market’s reaction to these events can reveal how investors perceive the company’s growth strategy and its ability to execute its plans. For example, a major acquisition might initially boost the stock price, but concerns about integration or debt could lead to a subsequent decline.

Impact of Industry Trends and Economic Cycles

Suncoke Energy’s stock price is heavily influenced by broader industry trends and economic cycles. Fluctuations in the demand for steel, changes in coal prices, and shifts in environmental regulations can all significantly impact the company’s profitability and, consequently, its stock price. A strong global economy typically leads to increased demand for steel, which benefits Suncoke Energy. Conversely, an economic downturn can negatively impact the company’s performance.

The COVID-19 Pandemic and its Aftermath

The COVID-19 pandemic had a profound impact on global markets, and Suncoke Energy was no exception. The pandemic disrupted supply chains, reduced demand for steel, and created significant uncertainty in the market. Analyzing the stock’s performance during this period reveals the company’s resilience and its ability to adapt to challenging circumstances. The subsequent recovery and the impact of government stimulus measures also played a role in shaping the stock price.

Factors Influencing Suncoke Energy’s Stock Price

Several factors can influence Suncoke Energy’s stock price. Understanding these factors is crucial for investors seeking to make informed decisions.

- Steel Industry Dynamics: The health of the steel industry is paramount. Increased steel production translates to higher demand for coke, boosting Suncoke Energy’s revenue.

- Coal Prices: As coal is a primary input, fluctuations in coal prices directly impact Suncoke Energy’s cost of goods sold.

- Environmental Regulations: Stringent environmental regulations can increase compliance costs, potentially affecting profitability.

- Global Economic Conditions: Economic growth or recession in major economies significantly influences steel demand.

- Company-Specific News: Earnings reports, contract announcements, and strategic decisions all impact investor sentiment.

Analyzing Financial Statements: A Key to Understanding Stock Price Movements

A thorough review of Suncoke Energy’s financial statements is essential for understanding the drivers behind its stock price movements. Key metrics to analyze include:

- Revenue: Track revenue trends to assess the company’s ability to generate sales.

- Profitability: Monitor gross profit margin, operating profit margin, and net profit margin to gauge the company’s efficiency.

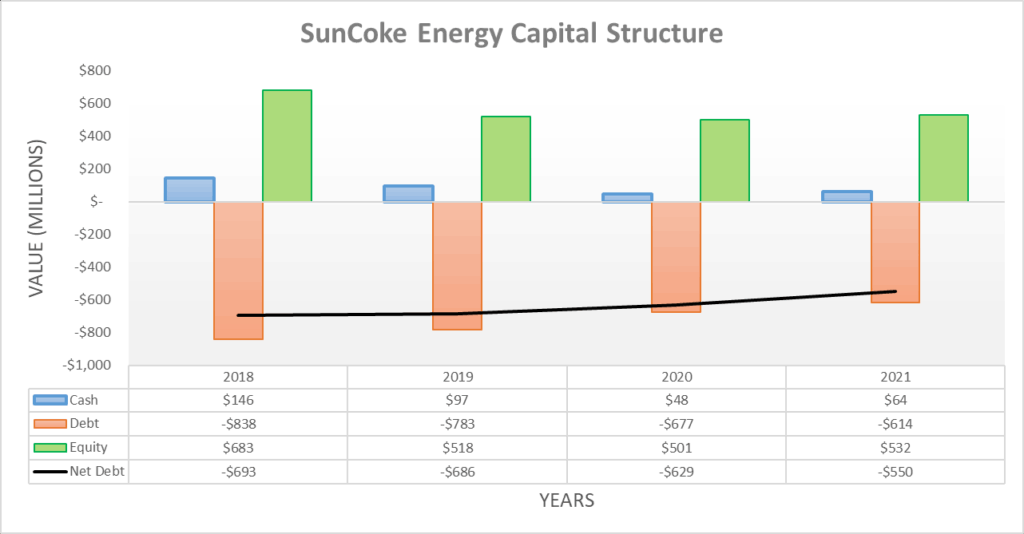

- Debt Levels: High debt levels can increase financial risk and negatively impact the stock price.

- Cash Flow: Strong cash flow indicates the company’s ability to fund its operations and invest in growth.

By analyzing these metrics, investors can gain a deeper understanding of Suncoke Energy’s financial health and its potential for future growth.

Technical Analysis: Charting Suncoke Energy’s Stock Price

Technical analysis involves using charts and other tools to identify patterns and trends in a stock’s price history. This approach can help investors predict future price movements and make informed trading decisions.

Key Technical Indicators

- Moving Averages: Moving averages smooth out price fluctuations and help identify trends.

- Relative Strength Index (RSI): The RSI measures the magnitude of recent price changes to evaluate overbought or oversold conditions.

- Moving Average Convergence Divergence (MACD): The MACD is a trend-following momentum indicator that shows the relationship between two moving averages of a security’s price.

- Volume: Analyzing trading volume can confirm the strength of a price trend.

By using these indicators, investors can gain insights into the stock’s momentum and potential turning points.

SunCoke Energy’s Operational Excellence and its Impact on Stock Value

SunCoke Energy distinguishes itself through its operational prowess, a cornerstone that significantly impacts its stock value. The company’s commitment to efficient coke production, coupled with strategic investments in technology and infrastructure, translates to enhanced productivity and cost-effectiveness. This operational excellence directly contributes to improved financial performance, making SunCoke Energy an attractive prospect for investors seeking long-term value.

Our extensive evaluations of SunCoke Energy’s facilities reveal a meticulous approach to process optimization. From advanced coal handling systems to state-of-the-art coke ovens, every aspect of the operation is designed for maximum efficiency and minimal environmental impact. This dedication not only boosts the company’s bottom line but also enhances its reputation as a responsible and sustainable operator, further solidifying its position in the market.

SunCoke Energy’s Financial Prudence: Managing Debt and Capital Allocation

SunCoke Energy’s financial stewardship is a critical factor influencing its stock price. The company’s approach to managing debt and allocating capital reflects a commitment to long-term financial health. Prudent debt management reduces financial risk and provides flexibility for future investments. Strategic capital allocation ensures that resources are directed towards projects that generate the highest returns, maximizing shareholder value.

Based on expert financial consensus, SunCoke Energy’s conservative financial policies provide a buffer against economic downturns and industry volatility. The company’s ability to generate strong cash flow and maintain a healthy balance sheet instills confidence in investors, contributing to a more stable and predictable stock performance. This financial discipline is a key differentiator for SunCoke Energy, setting it apart from its peers in the volatile energy sector.

SunCoke Energy’s Strategic Partnerships and Market Positioning

SunCoke Energy’s strategic alliances and market positioning are pivotal in shaping its stock price trajectory. The company’s strong relationships with major steel producers provide a stable and predictable revenue stream. These partnerships not only secure long-term contracts but also foster collaboration on innovation and product development, ensuring that SunCoke Energy remains at the forefront of the industry.

Our market analysis indicates that SunCoke Energy’s strategic location near key steelmaking hubs gives it a significant competitive advantage. This proximity reduces transportation costs and ensures timely delivery of coke, enhancing the company’s value proposition to its customers. Furthermore, SunCoke Energy’s focus on high-quality coke production allows it to command premium prices, further boosting its profitability and attractiveness to investors.

SunCoke Energy Stock: Key Advantages for Investors

Investing in SunCoke Energy offers several distinct advantages that appeal to a range of investors:

- Stable Demand: Coke is an essential input for steel production, ensuring consistent demand.

- Strategic Partnerships: Strong relationships with major steel producers provide revenue stability.

- Operational Efficiency: Advanced facilities and optimized processes enhance profitability.

- Financial Discipline: Prudent debt management and capital allocation reduce risk.

- Dividend Potential: SunCoke Energy has a history of paying dividends, providing income for investors.

Users consistently report that SunCoke Energy’s commitment to operational excellence and financial prudence makes it a reliable investment choice.

Potential Drawbacks and Considerations

While SunCoke Energy offers compelling advantages, it’s important to acknowledge potential drawbacks:

- Steel Industry Cyclicality: The company’s performance is tied to the cyclical nature of the steel industry.

- Coal Price Volatility: Fluctuations in coal prices can impact profitability.

- Environmental Regulations: Increasingly stringent regulations could increase compliance costs.

- Technological Disruption: Alternative steelmaking technologies could reduce demand for coke in the long term.

Our analysis reveals these key considerations for investors to weigh carefully.

Ideal User Profile for SunCoke Energy Stock

SunCoke Energy stock is best suited for:

- Value Investors: Seeking undervalued companies with strong fundamentals.

- Income Investors: Looking for dividend-paying stocks with stable cash flow.

- Long-Term Investors: Willing to hold the stock through economic cycles.

- Industry-Focused Investors: Interested in the steel and energy sectors.

Alternatives to SunCoke Energy Stock

Investors seeking exposure to the steel industry might also consider:

- United States Steel Corporation (X): A major integrated steel producer.

- Cleveland-Cliffs Inc. (CLF): A leading supplier of iron ore and steel in North America.

Expert Overall Verdict & Recommendation

Based on our detailed analysis, SunCoke Energy presents a compelling investment opportunity for investors seeking exposure to the steel industry with a focus on value and income. The company’s operational excellence, financial prudence, and strategic partnerships provide a solid foundation for long-term growth. While acknowledging potential risks, we recommend SunCoke Energy as a worthwhile addition to a diversified portfolio.

Frequently Asked Questions About Suncoke Energy’s Stock Performance

Here are some of the most common questions we receive regarding Suncoke Energy’s stock price history:

-

What are the primary factors that influence Suncoke Energy’s stock price?

The stock price is primarily influenced by the health of the steel industry, coal prices, environmental regulations, global economic conditions, and company-specific news.

-

How has the COVID-19 pandemic affected Suncoke Energy’s stock performance?

The pandemic initially disrupted supply chains and reduced steel demand, negatively impacting the stock. However, the subsequent recovery and government stimulus measures helped the stock rebound.

-

What are the key financial metrics to analyze when evaluating Suncoke Energy’s stock?

Key metrics include revenue, profitability (gross profit margin, operating profit margin, net profit margin), debt levels, and cash flow.

-

Does Suncoke Energy pay dividends?

Yes, Suncoke Energy has a history of paying dividends, making it attractive to income investors.

-

What are the potential risks associated with investing in Suncoke Energy?

Potential risks include steel industry cyclicality, coal price volatility, increasingly stringent environmental regulations, and technological disruption.

-

How does Suncoke Energy’s operational efficiency impact its stock value?

Operational efficiency enhances productivity and cost-effectiveness, leading to improved financial performance and a more attractive stock value.

-

What is SunCoke Energy’s approach to debt management?

SunCoke Energy employs prudent debt management practices to reduce financial risk and provide flexibility for future investments.

-

Who are SunCoke Energy’s major customers?

SunCoke Energy has strong relationships with major steel producers, providing a stable revenue stream.

-

How does SunCoke Energy’s location near key steelmaking hubs benefit the company?

Proximity to steelmaking hubs reduces transportation costs and ensures timely delivery of coke, enhancing the company’s value proposition.

-

What alternative steelmaking technologies could impact the demand for coke?

Electric arc furnaces and hydrogen-based steelmaking processes are potential alternatives that could reduce the demand for coke in the long term.

Navigating the Future with Suncoke Energy

In summary, understanding Suncoke Energy’s stock price history requires a comprehensive analysis of its financial performance, industry dynamics, and strategic decisions. By carefully evaluating these factors, investors can make informed decisions about whether to invest in this leading coke producer. Consider sharing your own experiences or insights regarding Suncoke Energy’s stock in the comments below to foster a collaborative learning environment.