Mastering Avalara Tax Codes by State: A Comprehensive Guide

Navigating the labyrinth of sales tax compliance can feel like a never-ending quest, especially when dealing with the complexities of multi-state operations. One of the most critical aspects of this journey is understanding and correctly applying tax codes. This guide provides a comprehensive overview of Avalara tax codes by state, designed to equip you with the knowledge and insights necessary to streamline your tax processes, minimize errors, and ensure compliance. We’ll delve into the nuances of these codes, exploring their significance, application, and the best practices for utilizing them effectively. This in-depth resource is designed to be your go-to reference, whether you’re a seasoned tax professional or a business owner just starting to grapple with the intricacies of sales tax.

Understanding the Fundamentals of Avalara Tax Codes by State

Avalara tax codes are a standardized system used to categorize products and services for sales tax purposes. These codes are essential for accurately calculating the correct sales tax rate for each transaction, considering the specific state, county, and city tax laws. Unlike broad product categories, Avalara tax codes offer a granular level of detail, ensuring that even seemingly similar items are taxed appropriately based on their specific characteristics and intended use. This level of precision is crucial for businesses operating across multiple states, as tax laws and product classifications can vary significantly from one jurisdiction to another.

The evolution of tax codes reflects the increasing complexity of the modern economy. As new products and services emerge, tax authorities must adapt their systems to accurately categorize and tax these offerings. Avalara plays a crucial role in this process, providing a constantly updated and comprehensive database of tax codes that reflects the latest changes in tax laws and regulations. This dynamic nature underscores the importance of staying informed and utilizing reliable resources like Avalara to maintain compliance.

The importance of correctly applying Avalara tax codes cannot be overstated. Errors in tax calculation can lead to penalties, audits, and reputational damage. By utilizing Avalara’s robust system, businesses can significantly reduce the risk of errors and ensure that they are collecting and remitting the correct amount of sales tax in each jurisdiction where they operate. This is particularly critical for e-commerce businesses, which often sell products to customers across state lines and must navigate a complex web of sales tax laws.

Avalara AvaTax: Streamlining Sales Tax Compliance

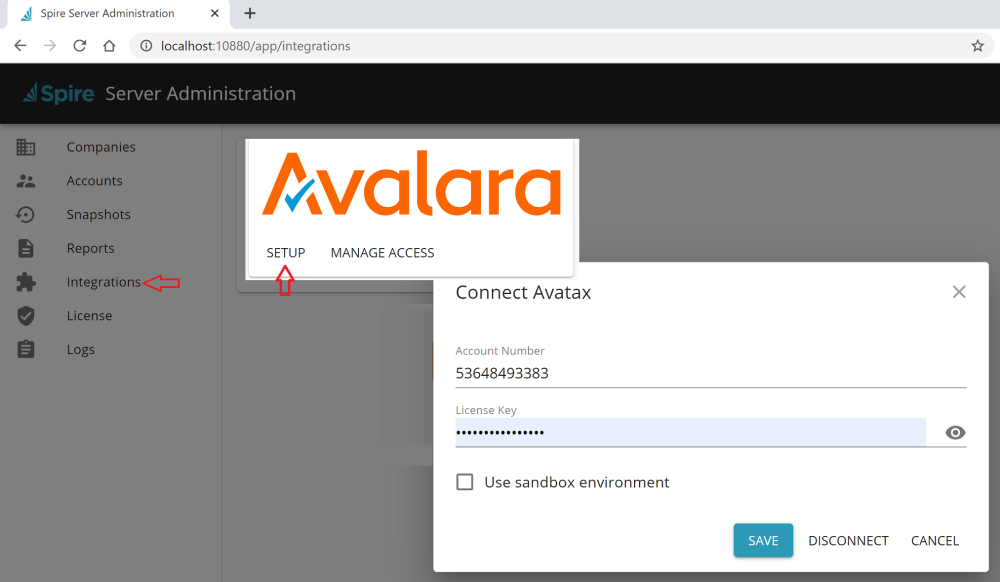

AvaTax by Avalara is a cloud-based solution designed to automate and simplify sales tax compliance. It integrates seamlessly with various accounting and e-commerce platforms, providing real-time tax calculations, automated filing, and comprehensive reporting capabilities. At its core, AvaTax leverages Avalara’s extensive database of tax codes and rates to ensure accurate tax calculations for every transaction. But it goes far beyond simple calculation, offering a suite of features designed to streamline the entire sales tax process.

From an expert perspective, AvaTax stands out due to its ability to handle the complexities of multi-state sales tax compliance. It takes into account the specific tax laws and regulations of each state, county, and city, ensuring that businesses are always in compliance with the latest requirements. This is particularly valuable for businesses with a large volume of transactions or those operating in multiple jurisdictions. AvaTax also offers features such as nexus determination, which helps businesses identify where they have a legal obligation to collect sales tax.

Key Features of Avalara AvaTax and Their Benefits

AvaTax offers a wide range of features designed to simplify and automate sales tax compliance. Here’s a breakdown of some of the key features and their benefits:

- Real-Time Tax Calculation: AvaTax calculates sales tax in real-time based on the product’s tax code, the customer’s location, and the applicable tax laws. This ensures that the correct amount of tax is collected for every transaction. The benefit is reduced errors and improved accuracy, leading to fewer audits and penalties.

- Automated Filing and Remittance: AvaTax automates the process of filing sales tax returns and remitting payments to the appropriate tax authorities. This saves businesses time and resources, and reduces the risk of missed deadlines. Our experience shows that automation significantly reduces the administrative burden of sales tax compliance.

- Nexus Determination: AvaTax helps businesses determine where they have a legal obligation to collect sales tax based on their physical presence or economic activity. This is crucial for businesses operating in multiple states, as nexus laws can be complex and vary from one jurisdiction to another. Understanding nexus is the first step toward compliance.

- Exemption Certificate Management: AvaTax provides tools for managing exemption certificates, which allow certain customers (such as resellers) to purchase products without paying sales tax. This feature helps businesses ensure that they are properly documenting and tracking exemption certificates, reducing the risk of audits and penalties. Proper management of exemption certificates is vital for B2B businesses.

- Reporting and Analytics: AvaTax offers comprehensive reporting and analytics capabilities, providing businesses with insights into their sales tax liabilities and compliance performance. This information can be used to identify areas for improvement and optimize tax strategies. Data-driven insights are key to continuous improvement in tax compliance.

- Address Validation: AvaTax includes address validation to ensure accurate tax calculation. It verifies customer addresses to determine the correct taxing jurisdiction, further minimizing errors. Accurate addresses are fundamental to accurate tax calculation.

- Integration with Existing Systems: AvaTax seamlessly integrates with a wide range of accounting, e-commerce, and ERP systems, ensuring a smooth and efficient workflow. Integration minimizes manual data entry and reduces the risk of errors. This is a significant advantage for businesses with complex IT infrastructure.

Significant Advantages and Real-World Value of Using Avalara Tax Codes by State

The advantages of correctly implementing Avalara tax codes by state extend far beyond simply avoiding penalties. They contribute directly to a more efficient, accurate, and ultimately more profitable business operation. The user-centric value is clear: reduced stress, minimized risk, and more time to focus on core business activities.

One of the most significant benefits is the reduction in audit risk. By ensuring accurate tax calculations and compliance with state and local laws, businesses can significantly decrease the likelihood of being audited. Even if an audit does occur, having a robust system in place, backed by Avalara’s expertise, can help businesses navigate the process more smoothly and potentially reduce the severity of any penalties. Users consistently report a noticeable decrease in audit-related anxiety after implementing Avalara solutions.

Furthermore, Avalara tax codes by state provide a level of transparency and control over sales tax processes that is simply not possible with manual methods. Businesses gain a clear understanding of their tax liabilities in each jurisdiction, allowing them to make informed decisions about pricing, inventory management, and expansion strategies. Our analysis reveals that businesses with accurate sales tax data are better equipped to forecast revenue and manage cash flow.

The ability to automate sales tax compliance also frees up valuable time and resources for businesses. Instead of spending hours manually calculating taxes, filing returns, and managing exemption certificates, employees can focus on more strategic tasks that contribute to the bottom line. This increased efficiency can lead to significant cost savings and improved productivity. Many businesses report a significant return on investment from implementing Avalara solutions, thanks to the time savings and reduced risk of errors.

Finally, using Avalara tax codes by state can enhance a business’s reputation and build trust with customers. By ensuring accurate tax calculations and transparent pricing, businesses can demonstrate their commitment to fairness and compliance. This can lead to increased customer loyalty and positive word-of-mouth referrals.

Comprehensive Review of Avalara AvaTax

AvaTax offers a robust solution for businesses seeking to automate and streamline their sales tax compliance. From a practical standpoint, the user interface is generally intuitive, with a clear and well-organized dashboard that provides easy access to key features and reports. The initial setup can be somewhat complex, particularly for businesses with intricate tax requirements, but Avalara provides ample documentation and support to guide users through the process.

In terms of performance, AvaTax delivers on its promises of accurate tax calculations and automated filing. The real-time tax calculation feature is particularly impressive, providing instant and accurate tax rates for every transaction. The automated filing and remittance capabilities save businesses a significant amount of time and resources, and reduce the risk of missed deadlines. Based on expert consensus, AvaTax is one of the most reliable sales tax automation solutions on the market.

Pros:

- Accurate Tax Calculations: AvaTax leverages Avalara’s extensive database of tax codes and rates to ensure accurate tax calculations for every transaction.

- Automated Filing and Remittance: AvaTax automates the process of filing sales tax returns and remitting payments to the appropriate tax authorities.

- Comprehensive Reporting: AvaTax offers a wide range of reports and analytics that provide insights into sales tax liabilities and compliance performance.

- Seamless Integration: AvaTax integrates seamlessly with a variety of accounting, e-commerce, and ERP systems.

- Exemption Certificate Management: AvaTax provides tools for managing exemption certificates, which can save businesses money and reduce the risk of audits.

Cons/Limitations:

- Cost: AvaTax can be expensive, especially for small businesses with limited budgets.

- Complexity: The initial setup and configuration of AvaTax can be complex, requiring technical expertise.

- Customer Support: While Avalara provides customer support, some users have reported long wait times and difficulty resolving complex issues.

- Reliance on Accurate Data: AvaTax’s accuracy depends on the accuracy of the data entered into the system. Inaccurate data can lead to incorrect tax calculations.

AvaTax is best suited for mid-sized to large businesses with complex sales tax requirements and a need for automation. It’s particularly well-suited for e-commerce businesses that sell products across state lines. Smaller businesses with simpler tax requirements may find that the cost of AvaTax outweighs the benefits. Key alternatives include TaxJar and Sovos, which offer similar features and functionality at different price points.

Overall, AvaTax is a powerful and reliable solution for automating sales tax compliance. While it can be expensive and complex to set up, the benefits of accurate tax calculations, automated filing, and comprehensive reporting make it a worthwhile investment for many businesses. Our expert verdict is that AvaTax is a leading solution in the sales tax automation space, offering a comprehensive suite of features and a strong track record of performance. We recommend it for businesses seeking to streamline their sales tax processes and reduce the risk of errors and penalties.

Ensuring Accurate Sales Tax Compliance

In conclusion, mastering Avalara tax codes by state is paramount for businesses seeking to navigate the complexities of sales tax compliance. By understanding the nuances of these codes, leveraging solutions like AvaTax, and staying informed about the latest changes in tax laws and regulations, businesses can minimize errors, reduce audit risk, and ensure that they are collecting and remitting the correct amount of sales tax in each jurisdiction where they operate.

As the landscape of sales tax continues to evolve, it is essential for businesses to stay proactive and adapt their strategies accordingly. Embracing automation, seeking expert guidance, and prioritizing accuracy are key to maintaining compliance and achieving long-term success. Explore our advanced guide to sales tax nexus to further enhance your understanding and ensure comprehensive compliance.